Those who are interested to learn about the fiasco of photovoltaics, a simple search on the internet for the period 2011 – 2014 will bring a plethora of results call photovoltaics "bubble" and a "fiasco".

The media headlines spoke of people losing their money, about the 'people's photovoltaics' and the 'farmers' movement'. For the following years, the energy sector was almost completely frozen. Even today, people have a strong fear of photovoltaics and remain very suspicious.

Even today, ten years later, the majority of our potential customers at ΙΩΝΙΚΗ Renewables still cite the "bubble" and the fiasco of photovoltaics as their primary objections, wondering whether they are worth it or not.

What had happened in 2011 in the area of energy? What is the reality? How much money was lost and who lost? There has been a "bubble" and fiasco of photovoltaics? In this article we will try to answer to all these questions, carrying our own experience and our customers at the time and we will present what we have learnt from an era that, in essence, has changed everything today.

The "trap" of the supplementary guaranteed income and the excessive returns created the fiasco of photovoltaics

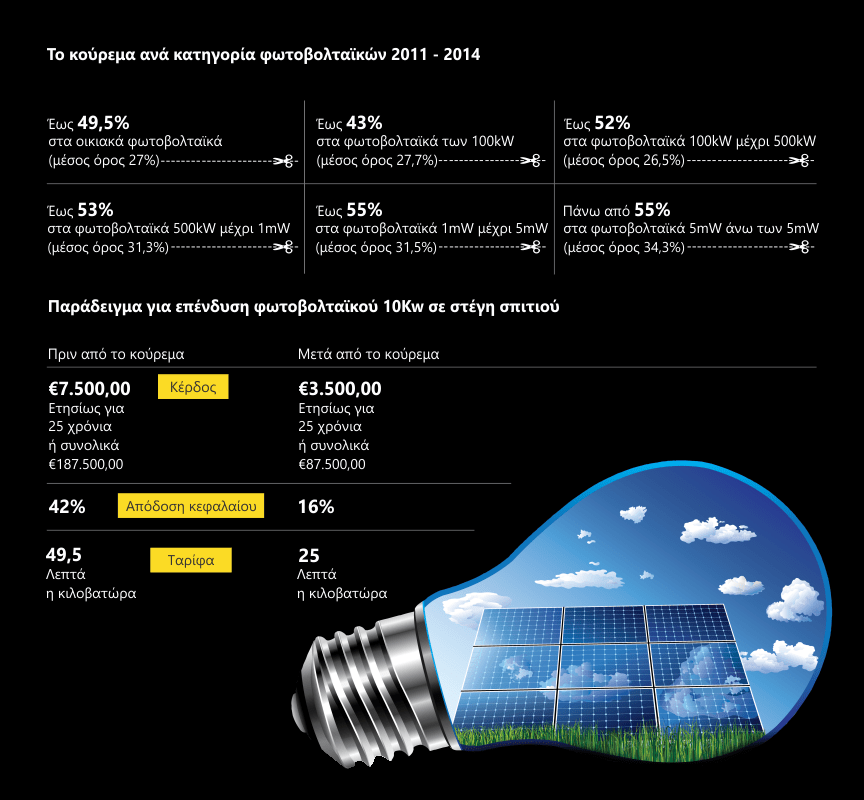

The guaranteed extra income and the returns on investment that reached up to 42% they had created a "fever" of interest for photovoltaics, especially in the period 2007-2009.

Then, all the solar panels were selling power to the grid. The parties they rubbed their hands that they would return on the investment in a very short period of time and I enjoyed so large a guaranteed annual returns.

In particular, a solar 10 kW generated annual revenues of €7.500. Such a sum was a huge incentive to install a photovoltaic system on the roof of his house.

The state subsidies and the communication mechanism to provoke interest, combined with the huge returns, should have alarmed everyone. However, in the quest for money, everyone seems to turn a deaf ear, mainly by choice. The 42% annual returns should have been a warning sign. It was clear that the situation was unsustainable. Even those interested, in the end, looked at how much money they would pocket from the "sure and guaranteed investment.

Wikipedia defines it as an investment in the "commitment of funds for a period of time, which is expected to bring additional funds to the investor". The key word here is "expected". An investor makes an investment which will yield a large profit, less profit, a refund or a loss. The guaranteed and profits are nowhere to be found. And we stress to our customers. On the contrary, there are safer investments and photovoltaics continue to be safe investments even after the big haircut came.

Investments in photovoltaics were still profitable even after the significant haircut of the guaranteed prices

The phrases "bubble" and fiasco of photovoltaic focused mainly on the "haircut" that was decided to be held on guaranteed prices. It was the money that they would lose annually to those who have invested in solar panels.

This haircut was very big as it turned out that the extra returns were not viable. In fact, the haircut has reduced the annual yields from 42% to 16%.

Ask anyone who deals with investments that looks a rate of annual return of 16% and he will answer you that it is very big.

This was the new reality and the money that they would lose the investors would be the additional profit that would have been obtained before clipping. For the rest of you interested, I don't, investments in pv had become unprofitable because you previously were 42% and 16%.

Think about it, that in Germany the annual returns that the period was 8% and in our country there were still extra returns.

Fiasco of photovoltaics: The €3,000-€4,000 that the "Farmers' Movement" was losing is an argument that photovoltaics are among the safest investments

During the era of the "bubble" and the fiasco of photovoltaics, the media was writing about saturated networks. The saturation led to the rejection of applications for permits for photovoltaic parks. As a result, farmers were losing €3,000–€4,000 that they had spent on studies and submitting their applications.

This is true today. At the same time is a big argument that photovoltaic is one of the safest investments, and we emphasize that the possibility of our customers.

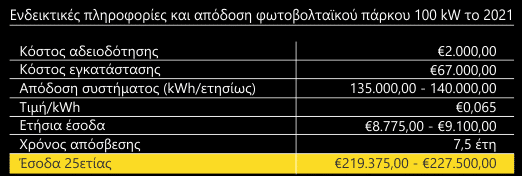

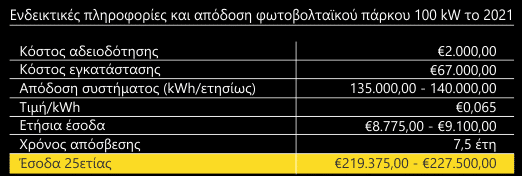

Today, the cost is approximately €2.000. Mention to any interested party that this is the biggest risk I take for an investment in solar park. There is the risk of rejection of the application so that the money will be lost.

If the application is approved and the contract for the sale prices of kilowatt-hours is signed, then the installation will take place. For a 100 kW photovoltaic park, the cost today is approximately €67,000, compared to €160,000 ten years ago.

So the question is, if it considers an interested party big or small the amount of €2.000, which can be lost in the 100% to collect from a park of 100 kW in the amount of €eur 227 500 the next 25 years, with the investment of €some 67,000 interval for the installation of the park only after the approval of the folder, and "lock" the sales price of electricity on the network.

Make it specific investment safe? In our opinion, yes, and let's see an example below from the same company.

At ΙΩΝΙΚΗ Renewables, we do what we tell our customers

As a company that, like all others, aims to reduce operating costs and increase profitability, we are constantly seeking ways to finance and invest that will lead ΙΩΝΙΚΗ Renewables to growth.

The last time we looked at several investments in order to see which would be the most advantageous with the best risk-reward ratio.

Having to choose from a wide range of investment products, and financial institutions, we have reached a conclusion. How a solar park is currently an investment that will yield annual returns of over 10% with greater security and fewer chances of losses.

So just as we advise and our customers, we decided to proceed with the installation of one of our own solar park. As shown in the following figure, this time in the building, with the bases of the panels have already been installed.

The bankrupt photovoltaic companies: When money is not a good advisor and quality is ignored

During that period of "haircuts," unprofitable photovoltaics, and farmers losing money, there were also the bankruptcies of many photovoltaic companies. These particular news stories further intensified the negative atmosphere that had been created.

The expansion of chinese companies lead to a great reduction in the cost of the equipment. When the profit and money is the only factor assessment and decision-making, once it is spinning boomerang and in the case of photovoltaic led many companies into bankruptcy.

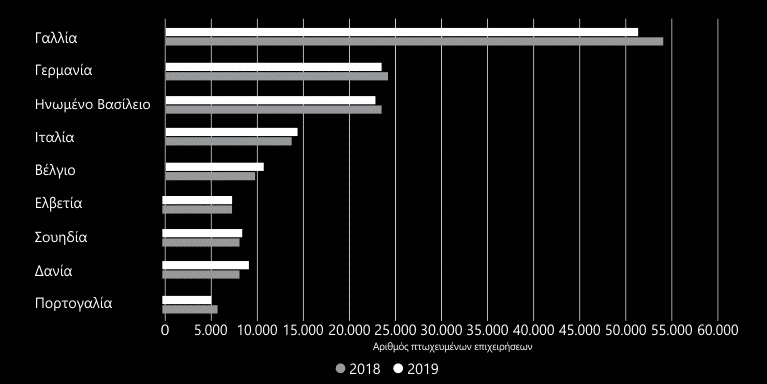

It has nothing to do with whether they were in the photovoltaic sector. Their business models were not structured correctly. Every year, thousands of companies declare bankruptcy for the same reasons that the photovoltaic companies did back then.

In the graph below, you can see how France 2018 & 2019 had over 50,000 bankruptcies.

Narrow profit margins

In our sector, we work with very small profit margins. At a price of €67,000 for a photovoltaic park, in many cases, over 90% is production cost for a company that procures panels, mounts, inverters, etc.

When focused, and the company and the customer only on price, then the profit margins are decreasing, starting with liquidity problems, led to loans, then failed to pay and in the end in bankruptcy. That's what happens in all the bankrupt companies regardless of industry. The customers do not, led to a selection of not-so-quality materials that reduce the efficiency and productivity of photovoltaic them.

For this reason, we in the ΙΩΝΙΚΗ Renewables standing in value and quality and not on price. Our prices are competitive but you will surely find cheaper photovoltaic elsewhere. We do not negotiate the quality and the value that we want to give to our customer. Especially for a product that has, for almost 30 years.

The experience of ΙΩΝΙΚΗ Renewables and our own customers

In 2011, all experiencing the economic crisis and many people came to the threshold of the decision on if you should invest in something or not.

At that time, in fact, all of "raise" their money from the banks. The stockists of in the house or in their offices. Was fear of the lending of the banks which had risen to dizzying heights.

The law passed for the photovoltaic looked like as a plank of savior for the simple world. With a photovoltaic installation on the roof could sell the electricity produced.

As something new, in the beginning, I had great success and attracted mostly people with quite banked money. The first facility of our company appeared at the level of 10-20 per area the first year with a cost ranging from to €32,000 – €35.000.

The attractive yields and the continued fall in the cost of installation and the first signs of the world who put solar panels on their roofs, were turning more and more people to the solar panels.

The stabilization of installation prices and the initial drops in kilowatt-hour prices

Because of the increased demand, increased supply of photovoltaic panels, base and inverter installation costs have stabilized in an amount of between €25,000 and €28.000, with the odds to become even more attractive.

The investment payback period was achieved in just 4.5 years, and photovoltaic system installations saw a wildly upward trajectory. At ΙΩΝΙΚΗ Renewables, within just 2.5 years during that period, we had installed 34 photovoltaic systems—an average of one installation every two months.

Then came the infamous legislation that would cut kilowatt-hour prices by about half. This was followed by yet another law further reducing kilowatt-hour prices to €0.08–€0.12. Photovoltaics now seemed unprofitable compared to previous pricing levels.

The introduction of net metering that changed the game

The 2014-2015 began to enter our lives, net metering, which was destined to change forever the data in the field of photovoltaics.

With net metering exchanged the power generated by the energy consumption and in the case of abundance, is stored in the network for three years, or in the event that the production does not cover the consumption, the owner pays only the difference.

In this way, households and business instead of taking out money every year, they could save money by forcing the bills power consumption on them.

In the beginning there were difficulties as well as the depreciation happen in 10 years. With the current reduced rates of installation, however, the damping is achieved much earlier. The net metering photovoltaics are now the ideal solution for homes and businesses.

The lesson, it seems it was a lesson, and for the state. Today, the conditions for the installation of a photovoltaic system is more favorable than ever. We do not know, however, what may happen in the future.

Our customers today, ten years later

The results of our company, all of this is very positive. Especially if we consider that we have been active mainly in the years of the economic crisis and the crisis of the pv.

Thinking always in the best interest of our customers and presenting facts and opinions with honesty and integrity, we have been able to build a particular relationship of trust with our customers.

With the cost price and selling energy, the simple acts of showing a payback within five years. So right now, we have customers who have achieved the depreciation of their investment. Now photovoltaic systems are a part of their annual income.

Even customers who had to be financed through a loan, today ten years later, they see their income increased.

The honest guide from our company, and the mature decisions of our customers, demonstrate, over time, that the pv was a profitable investment for the period of the crisis.

This is the reason why 30% of our clients have expressed interest in setting up photovoltaic park 100kW – 500kW.

Conclusion

All industries and businesses spend upward and downward periods. For us the most important thing is, what values it stands for each company, and if you treat customers with respect or profit.

As a company that started around the same time in the crisis, and indeed in a small town such as Texas, which most people know each other, we couldn't help but to treat our customers with respect and honesty. When we were sitting at the same table we opened our cards all sides and take the appropriate decisions, either positive or negative.

Today, we are pleased that this approach has paid off, and right now we serve all over Greece we are still dealing with all of our customers with the same honesty and respect in every part of the country and if they are.

Photovoltaics by ΙΩΝΙΚΗ Renewables: By your side every step of the way

At ΙΩΝΙΚΗ Renewables, we have experience in the study and installation of photovoltaics. We have installed photovoltaic parks as well as systems for residences and businesses throughout Greece, including islands. We handle all the processes, from potential financing to the study, the submission of the application, the installation, and we deliver your photovoltaic system turnkey.

Are you interested in photovoltaic; Click on the button “I Want a phone appointment” below, fill out the form and a competent engineer will contact with you to solve all your questions and to guide you to the right decision.

What did the "bubble" and the fiasco of photovoltaics in 2011 teach us?

George Kotakis

Electrical Engineer |

ΙΩΝΙΚΗ Autonomous

Those who are interested to learn about the fiasco of photovoltaics, a simple search on the internet for the period 2011 – 2014 will bring a plethora of results call photovoltaics "bubble" and a "fiasco".

The media headlines spoke of people losing their money, about the 'people's photovoltaics' and the 'farmers' movement'. For the following years, the energy sector was almost completely frozen. Even today, people have a strong fear of photovoltaics and remain very suspicious.

Even today, ten years later, the majority of our potential customers at ΙΩΝΙΚΗ Renewables still cite the "bubble" and the fiasco of photovoltaics as their primary objections, wondering whether they are worth it or not.

What had happened in 2011 in the area of energy? What is the reality? How much money was lost and who lost? There has been a "bubble" and fiasco of photovoltaics? In this article we will try to answer to all these questions, carrying our own experience and our customers at the time and we will present what we have learnt from an era that, in essence, has changed everything today.

The "trap" of the supplementary guaranteed income and the excessive returns created the fiasco of photovoltaics

The guaranteed extra income and the returns on investment that reached up to 42% they had created a "fever" of interest for photovoltaics, especially in the period 2007-2009.

Then, all the solar panels were selling power to the grid. The parties they rubbed their hands that they would return on the investment in a very short period of time and I enjoyed so large a guaranteed annual returns.

In particular, a solar 10 kW generated annual revenues of €7.500. Such a sum was a huge incentive to install a photovoltaic system on the roof of his house.

The state subsidies and the communication mechanism to provoke interest, combined with the huge returns, should have alarmed everyone. However, in the quest for money, everyone seems to turn a deaf ear, mainly by choice. The 42% annual returns should have been a warning sign. It was clear that the situation was unsustainable. Even those interested, in the end, looked at how much money they would pocket from the "sure and guaranteed investment.

Wikipedia defines it as an investment in the "commitment of funds for a period of time, which is expected to bring additional funds to the investor". The key word here is "expected". An investor makes an investment which will yield a large profit, less profit, a refund or a loss. The guaranteed and profits are nowhere to be found. And we stress to our customers. On the contrary, there are safer investments and photovoltaics continue to be safe investments even after the big haircut came.

Investments in photovoltaics were still profitable even after the significant haircut of the guaranteed prices

The phrases "bubble" and fiasco of photovoltaic focused mainly on the "haircut" that was decided to be held on guaranteed prices. It was the money that they would lose annually to those who have invested in solar panels.

This haircut was very big as it turned out that the extra returns were not viable. In fact, the haircut has reduced the annual yields from 42% to 16%.

Ask anyone who deals with investments that looks a rate of annual return of 16% and he will answer you that it is very big.

This was the new reality and the money that they would lose the investors would be the additional profit that would have been obtained before clipping. For the rest of you interested, I don't, investments in pv had become unprofitable because you previously were 42% and 16%.

Think about it, that in Germany the annual returns that the period was 8% and in our country there were still extra returns.

Fiasco of photovoltaics: The €3,000-€4,000 that the "Farmers' Movement" was losing is an argument that photovoltaics are among the safest investments

During the era of the "bubble" and the fiasco of photovoltaics, the media was writing about saturated networks. The saturation led to the rejection of applications for permits for photovoltaic parks. As a result, farmers were losing €3,000–€4,000 that they had spent on studies and submitting their applications.

This is true today. At the same time is a big argument that photovoltaic is one of the safest investments, and we emphasize that the possibility of our customers.

Today, the cost is approximately €2.000. Mention to any interested party that this is the biggest risk I take for an investment in solar park. There is the risk of rejection of the application so that the money will be lost.

If the application is approved and the contract for the sale prices of kilowatt-hours is signed, then the installation will take place. For a 100 kW photovoltaic park, the cost today is approximately €67,000, compared to €160,000 ten years ago.

So the question is, if it considers an interested party big or small the amount of €2.000, which can be lost in the 100% to collect from a park of 100 kW in the amount of €eur 227 500 the next 25 years, with the investment of €some 67,000 interval for the installation of the park only after the approval of the folder, and "lock" the sales price of electricity on the network.

Make it specific investment safe? In our opinion, yes, and let's see an example below from the same company.

At ΙΩΝΙΚΗ Renewables, we do what we tell our customers

As a company that, like all others, aims to reduce operating costs and increase profitability, we are constantly seeking ways to finance and invest that will lead ΙΩΝΙΚΗ Renewables to growth.

The last time we looked at several investments in order to see which would be the most advantageous with the best risk-reward ratio.

Having to choose from a wide range of investment products, and financial institutions, we have reached a conclusion. How a solar park is currently an investment that will yield annual returns of over 10% with greater security and fewer chances of losses.

So just as we advise and our customers, we decided to proceed with the installation of one of our own solar park. As shown in the following figure, this time in the building, with the bases of the panels have already been installed.

The bankrupt photovoltaic companies: When money is not a good advisor and quality is ignored

During that period of "haircuts," unprofitable photovoltaics, and farmers losing money, there were also the bankruptcies of many photovoltaic companies. These particular news stories further intensified the negative atmosphere that had been created.

The expansion of chinese companies lead to a great reduction in the cost of the equipment. When the profit and money is the only factor assessment and decision-making, once it is spinning boomerang and in the case of photovoltaic led many companies into bankruptcy.

It has nothing to do with whether they were in the photovoltaic sector. Their business models were not structured correctly. Every year, thousands of companies declare bankruptcy for the same reasons that the photovoltaic companies did back then.

In the graph below, you can see how France 2018 & 2019 had over 50,000 bankruptcies.

Narrow profit margins

In our sector, we work with very small profit margins. At a price of €67,000 for a photovoltaic park, in many cases, over 90% is production cost for a company that procures panels, mounts, inverters, etc.

When focused, and the company and the customer only on price, then the profit margins are decreasing, starting with liquidity problems, led to loans, then failed to pay and in the end in bankruptcy. That's what happens in all the bankrupt companies regardless of industry. The customers do not, led to a selection of not-so-quality materials that reduce the efficiency and productivity of photovoltaic them.

For this reason, we in the ΙΩΝΙΚΗ Renewables standing in value and quality and not on price. Our prices are competitive but you will surely find cheaper photovoltaic elsewhere. We do not negotiate the quality and the value that we want to give to our customer. Especially for a product that has, for almost 30 years.

The experience of ΙΩΝΙΚΗ Renewables and our own customers

In 2011, all experiencing the economic crisis and many people came to the threshold of the decision on if you should invest in something or not.

At that time, in fact, all of "raise" their money from the banks. The stockists of in the house or in their offices. Was fear of the lending of the banks which had risen to dizzying heights.

The law passed for the photovoltaic looked like as a plank of savior for the simple world. With a photovoltaic installation on the roof could sell the electricity produced.

As something new, in the beginning, I had great success and attracted mostly people with quite banked money. The first facility of our company appeared at the level of 10-20 per area the first year with a cost ranging from to €32,000 – €35.000.

The attractive yields and the continued fall in the cost of installation and the first signs of the world who put solar panels on their roofs, were turning more and more people to the solar panels.

The stabilization of installation prices and the initial drops in kilowatt-hour prices

Because of the increased demand, increased supply of photovoltaic panels, base and inverter installation costs have stabilized in an amount of between €25,000 and €28.000, with the odds to become even more attractive.

The investment payback period was achieved in just 4.5 years, and photovoltaic system installations saw a wildly upward trajectory. At ΙΩΝΙΚΗ Renewables, within just 2.5 years during that period, we had installed 34 photovoltaic systems—an average of one installation every two months.

Then came the infamous legislation that would cut kilowatt-hour prices by about half. This was followed by yet another law further reducing kilowatt-hour prices to €0.08–€0.12. Photovoltaics now seemed unprofitable compared to previous pricing levels.

The introduction of net metering that changed the game

The 2014-2015 began to enter our lives, net metering, which was destined to change forever the data in the field of photovoltaics.

With net metering exchanged the power generated by the energy consumption and in the case of abundance, is stored in the network for three years, or in the event that the production does not cover the consumption, the owner pays only the difference.

In this way, households and business instead of taking out money every year, they could save money by forcing the bills power consumption on them.

In the beginning there were difficulties as well as the depreciation happen in 10 years. With the current reduced rates of installation, however, the damping is achieved much earlier. The net metering photovoltaics are now the ideal solution for homes and businesses.

The lesson, it seems it was a lesson, and for the state. Today, the conditions for the installation of a photovoltaic system is more favorable than ever. We do not know, however, what may happen in the future.

Our customers today, ten years later

The results of our company, all of this is very positive. Especially if we consider that we have been active mainly in the years of the economic crisis and the crisis of the pv.

Thinking always in the best interest of our customers and presenting facts and opinions with honesty and integrity, we have been able to build a particular relationship of trust with our customers.

With the cost price and selling energy, the simple acts of showing a payback within five years. So right now, we have customers who have achieved the depreciation of their investment. Now photovoltaic systems are a part of their annual income.

Even customers who had to be financed through a loan, today ten years later, they see their income increased.

The honest guide from our company, and the mature decisions of our customers, demonstrate, over time, that the pv was a profitable investment for the period of the crisis.

This is the reason why 30% of our clients have expressed interest in setting up photovoltaic park 100kW – 500kW.

Conclusion

All industries and businesses spend upward and downward periods. For us the most important thing is, what values it stands for each company, and if you treat customers with respect or profit.

As a company that started around the same time in the crisis, and indeed in a small town such as Texas, which most people know each other, we couldn't help but to treat our customers with respect and honesty. When we were sitting at the same table we opened our cards all sides and take the appropriate decisions, either positive or negative.

Today, we are pleased that this approach has paid off, and right now we serve all over Greece we are still dealing with all of our customers with the same honesty and respect in every part of the country and if they are.

Photovoltaics by ΙΩΝΙΚΗ Renewables: By your side every step of the way

At ΙΩΝΙΚΗ Renewables, we have experience in the study and installation of photovoltaics. We have installed photovoltaic parks as well as systems for residences and businesses throughout Greece, including islands. We handle all the processes, from potential financing to the study, the submission of the application, the installation, and we deliver your photovoltaic system turnkey.

Are you interested in photovoltaic; Click on the button “I Want a phone appointment” below, fill out the form and a competent engineer will contact with you to solve all your questions and to guide you to the right decision.